Does Your Native Financial Institution Need Loan Capital?

Oweesta offers a variety of loan products to provide financing capital for Native CDFIs and other tribal or nonprofit loan funds. Borrowers must be Native-controlled and have a primary mission of serving Native communities. We do not offer loans directly to individuals or businesses.

Loan applications are accepted year-round and can be completed through Lenderfit. Please contact Jamie Olson at jamie@oweesta.org to begin the application process or get more information.

Organizations in operation for less than three years or who have yet to begin lending are encouraged to apply.

About Our Lending Products

This is Oweesta’s capitalization loan product, used by most of our Native CDFI borrowers. Funds can be used to make any kind of loans in the borrower’s self-identified target market.

- Up to $1,000,000 loan size

- Interest Rate – Cost of capital + 1.5 – 2.5%

- Term – Up to 5 years

- Unsecured

- Structured to match expected loan volume

- Quarterly payments, first year interest only payments

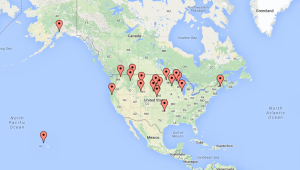

Map of Current Native CDFIs

current loans out

(as of March 31, 2025)

current loan portfolio

(as of Dec. 31, 2025)

loans past due